If you want to find out if buying a house is more affordable than renting, you have to get your calculator and do the math yourself. The cost of buying a home has put a damper on the outlook of first time home buyers, but there are situations where buying a house can actually be cheaper than renting.

It’s truly not all doom and gloom for the housing market. Even typically expensive cities like Burlington, Milton and Oakville have houses that are selling anywhere from the $400,000 to $500,000 marks.

If you are renting but plan to live outside big cities like Toronto, after doing some calculations you may find that you’re better off buying a house instead of renting for the rest of your life.

Example Situations

Let’s first remember the following with respect to rental price increases:

The rent increase guideline is 2.2% for increases between January 1 and December 31, 2020. [source]

This means that in the current year 2020, your landlord can increase your rent by 2.2%.

If you paid $1350.00 last year for rent, your landlord can increase your rent this year to $1380.00 per month.

The above percentage will be used in our calculations as to whether buying a house is better then renting.

Now we’ll jump into the typical monthly costs to own a home that was bought at the price of $450,000 with a down payment of $60,000.

- Home Price: $450,000

- Down payment: $60,000

- Property Tax: $194 (average)

- Utilities per month: $600

The above leaves you with a monthly mortgage payment of $2,194.00.

Now I know what you’re saying to yourself. “How can I afford over $2000 a month?”

Well, let’s go back to our rental prices and rental increases.

If last year your rent was $1350.00 per month, it can be increased to $1380.00.

Next year (2021), at the same 2.2% rate increase, it can go up to $1411.00 per mont

In 2022 your rent can be increased to $1443.00 per month, and that’s only if the rental increase percentage remains at 2.2%. If it goes up, so will the amount of your rental increase.

In 2023, at a 2.2% increase, you rent will be $1472.00. You’re almost at $1500.00 per month.

In 2024 you can expect to pay a minimum rental increase of $1505.00 a month.

In two more years you’ll be paying upwards of $1600.00 a month for rent.

Do you see where I’m going with this? I used the following percentage change calculator to figure out the above numbers, but the results were quite humble because rental increase percentages change every year and usually go up.

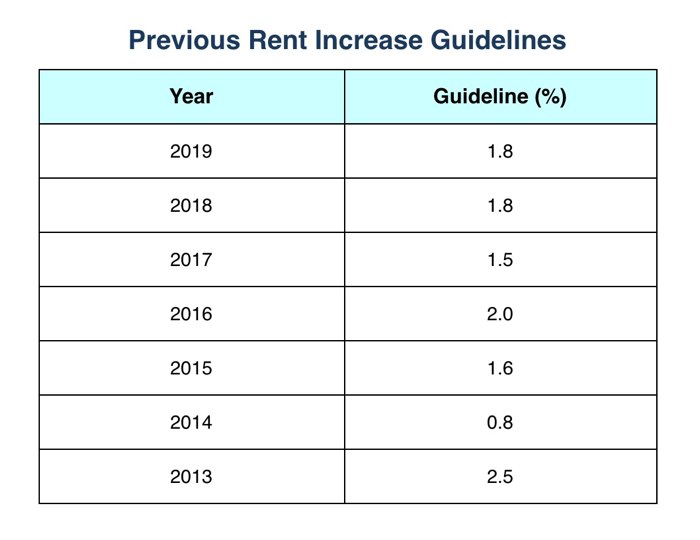

See the rental increase percentages for the year 2013 to 2019

With the cost of buying a home apparently increasing every year, combined with the cost to rent going up every year, it’s not hard to see how buying a home can actually be cheaper in the long run.

Financial benefits to owning a home

The best part about owning a home is that every penny you put into it, reduces your loan amount, and goes right into your pocket. If you buy new, there’s a pretty high chance the value of your home will increase so even if you have to forfeit, you would still make a few thousand dollars.

If you buy a pre-owned home, you’ll probably still make money if you have to sell because the cost of homes is increasing every year.

If you buy a pre-owned home, you’ll probably still make money if you have to sell because the cost of homes is increasing every year.

To put it plainly, If you manage to raise enough for a decent down payment, now is the time to get into the market.

What if I live with my parents?

If you live with your parents, I have some urgent news for you. Get out and buy a house as soon as you can.

The average cost in 2020 for renting a two bedroom apartment is $1800.00. With yearly rental increases, that cost is easily going to go above $2300.00 within 5 years.

Ask yourself: are you really willing to pay $2300.00 a month for an apartment?

If you live at home, read this other article that will give you some help on buying your first home, and then share this article with your parents and ask them for help with a down payment.

The way the market is moving and how house and rental prices are constantly increasing, this could be your only hope for getting into a home before it’s too late.

Be First to Comment